Liga Stavok

Liga Stavok is one of the largest betting companies in Russia, with over 2 million active users. Founded in 2008, the company offers a wide range of bets on sports events, including popular sports and eSports.

UX Research

A/B tests

Problem

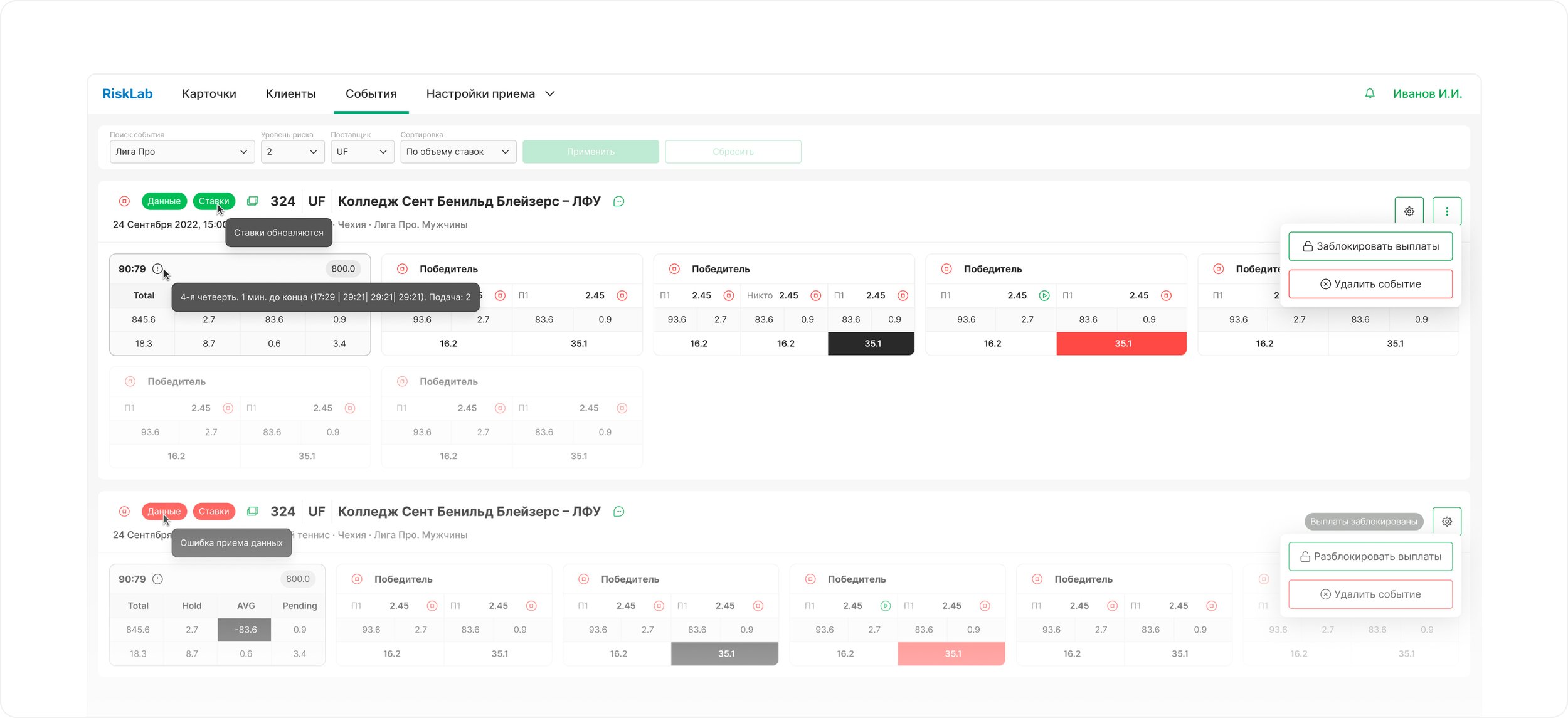

Develop an internal fraud monitoring system for the risk department. Key requirements: a user-friendly interface for real-time tracking of suspicious transactions, an automatic risk alert system, and tools for detailed data analysis.

User Interviews

Process

After completing the initial stages (analysis of existing fraud monitoring systems, stakeholder interviews, user testing and Customizer Journey Map), we developed a step-by-step workflow. We divided the entire service into sections (clients, bet flow, events, personal account, and betting settings) and over the course of 1.5 years, we gradually developed each section, repeating the stages as needed.

In developing the system, we aimed to implement elements and patterns that users are already familiar with from popular systems and professional platforms. This approach helped reduce the learning curve and improve usability

Forms and tables:

We used familiar patterns like tabular data views with filters and sorting, commonly found in CRM systems and analytics platforms.

Navigation

Intuitive navigation elements, similar to those used in well-known services like Google Analytics or Jira, were implemented to ensure users could easily navigate the system.

Notifications and alerts

We applied standard notification patterns, often seen in enterprise systems, such as real-time alerts for suspicious activities.

User account

We based the user account interface on familiar solutions from financial and analytical platforms, including user profiles, settings, and personalized dashboards.

Throughout the project, we conducted over 100 interviews with both users and stakeholders, gathering invaluable insights to refine the product. Additionally, we performed numerous rounds of usability testing to ensure the system met real-world needs. Working within a Scrum framework, I structured the process to engage all necessary participants, particularly

focusing on collaboration with analysts, designers, and business representatives. This approach ensured a well-rounded and comprehensive development process, resulting in a highly effective and user-friendly solution tailored to the needs of the risk department.

Results

As a result of the work, an effective fraud monitoring system was created that meets the needs of the risk department. Through extensive interviews, usability tests, and a well-coordinated team effort following the Scrum methodology, the system became intuitive and seamlessly integrated into the company's workflows.